The AI Frenzy continues to dominate headlines, with the trend undoubtedly going nowhere anytime soon. It’s reasonable to understand why are so many bullish on the development, regularly compared to the internet boom in the early 2000’s.

But outside of NVIDIA NVDA, there are several lesser-known plays on the AI Frenzy, a list that includes Credo Technology CRDO and Comfort Systems USA FIX. Let’s take a closer look at each.

Credo Sees Growth Surge

Credo Technology provides innovative, secure, high-speed connectivity solutions that deliver improved power efficiency as data rates and corresponding bandwidth requirements increase exponentially throughout the data infrastructure market.

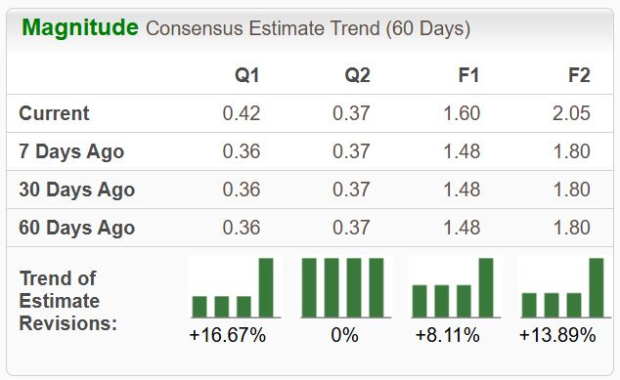

The company’s EPS outlook remains bullish nearly across the board, with analysts raising expectations following its latest release.

Image Source: Zacks Investment Research

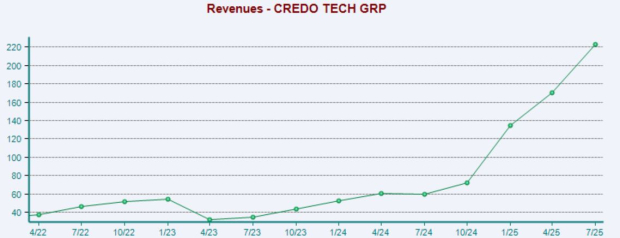

Credo’s latest set of quarterly results was fueled by continued strong demand for its services, with the company a big beneficiary of the AI frenzy. CRDO crushed our consensus expectations, with sales up a staggering 180% year-over-year. Below is a chart illustrating the company’s sales on a quarterly basis, with the acceleration visibly seen over the past few periods.

Image Source: Zacks Investment Research

FIX Enjoys Bullish Outlook

FIX shares represent a nice opportunity to obtain exposure to the AI infrastructure buildout thanks to its products utilized in data centers, which reflect a massive tailwind for the near and long-term picture for the stock.

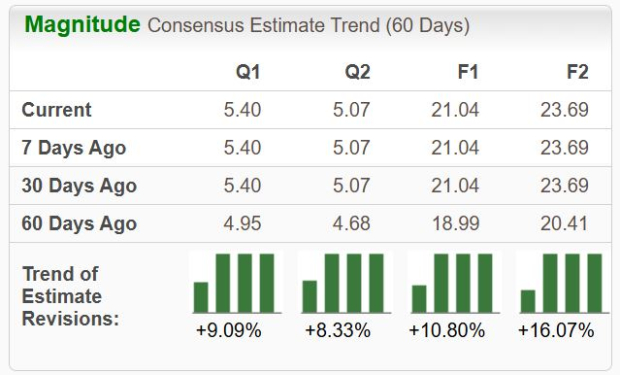

The stock sports the highly-coveted Zacks Rank #1 (Strong Buy), with EPS revisions moving higher across the board.

Image Source: Zacks Investment Research

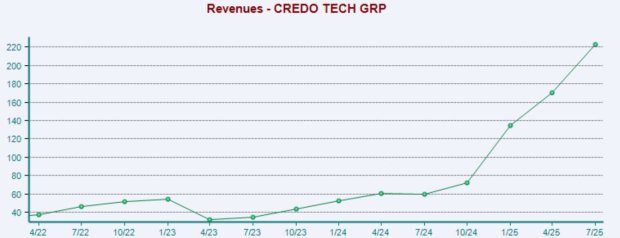

Sales of $2.2 billion and adjusted EPS of $6.53 in its latest release crushed our consensus estimates, reflecting growth rates of 20% and 75%, respectively. As shown below, FIX’s sales growth has been stellar, underpinned by a growing backlog.

Image Source: Zacks Investment Research

Bottom Line

We won’t be escaping the AI frenzy anytime soon, with many companies benefiting nicely from the demand.

Though NVIDIA NVDA and other recognizable names have been the typical AI ‘targets’, both stocks above – Comfort Systems USA FIX and Credo Technology CRDO – reflect lesser-known plays on the trade.

Zacks Names #1 Semiconductor Stock

This under-the-radar company specializes in semiconductor products that titans like NVIDIA don't build. It's uniquely positioned to take advantage of the next growth stage of this market. And it's just beginning to enter the spotlight, which is exactly where you want to be.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $971 billion by 2028.

See This Stock Now for Free >>NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Comfort Systems USA, Inc. (FIX) : Free Stock Analysis Report

Credo Technology Group Holding Ltd. (CRDO) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.