There are many ways that companies can keep shareholders happy, whether that be through robust quarterly performance or rock-solid financials.

In addition, companies can also demonstrate a shareholder-friendly nature by offering consistent dividend payouts and implementing share repurchase programs.

But what are the benefits of each? Let’s take a closer look.

Buybacks Can Put in a Floor for Shares

Stock buybacks, also known as share repurchase programs, are commonly executed by companies to boost shareholder value.

A stock buyback occurs when a company purchases outstanding shares of its stock. In its simplest form, buybacks represent companies essentially re-investing in themselves. Reducing the number of outstanding shares can boost earnings per share (EPS), making a company's financial position more attractive to prospective investors.

Further, buybacks can help put in a floor for shares, reflective of consistent buying pressure.

In recent years, stock buybacks have become a popular strategy among large-cap companies, particularly in sectors with significant cash reserves, specifically technology. Apple AAPL, a mega-cap tech giant, recently unveiled the biggest buyback in corporate history totaling $110 billion.

Apple has been aggressively buying back its shares over the years, as illustrated below.

Image Source: Zacks Investment Research

Still, it’s worth mentioning that buybacks can sometimes bring out the critics, as some believe the cash could be better deployed elsewhere, such as R&D. Nonetheless, buybacks are generally a net positive for shareholders, particularly those of mature companies with little growth left to squeeze.

Dividends Reflect Passive Income

Dividend payments are investors’ versions of paydays within the stock market.

Dividends provide a passive income stream, limit the impact of drawdowns in other positions, provide more than one way to profit from an investment, and provide the ability to reap maximum returns through dividend reinvestment.

And with a little positioning, investors can actually build a portfolio that generates monthly income despite most companies paying on a quarterly basis.

For example –

The first stock pays its dividend in January, April, July, and October. The second stock pays out in February, May, August, and November. Finally, the third stock pays its dividend in March, June, September, and December.

Companies that have been paying dividends for decades reflect not only a shareholder-friendly but also a stable nature, flexing the ability to share a portion of profits through all economic cycles, good or bad.

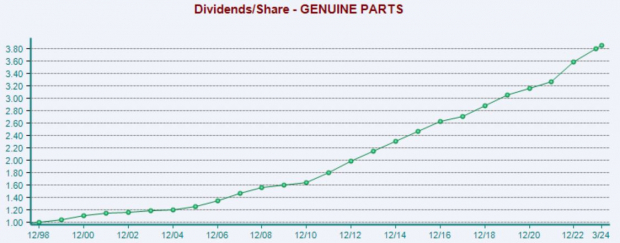

A great example of a company that’s consistently paid dividends is Genuine Parts Co. GPC, which currently sports a favorable Zacks Rank #2 (Buy). Below is a chart illustrating GPC’s dividends paid on an annual basis dating all the way back to 1998.

Image Source: Zacks Investment Research

Bottom Line

Buybacks and consistent dividends please shareholders, reflecting an investor-friendly nature. We’ve seen many companies announce sizable buybacks over recent years, with the most famous example undoubtedly being Apple AAPL with its $110 billion buyback announcement.

Companies that can consistently pay dividends are undoubtedly a favorite as well, with Genuine Parts Co. GPC, a current Zacks Rank #2 (Buy), holding the ranks of a Dividend King.

Top 5 Dividend Stocks for Your Retirement

Zacks targets 5 well-established companies with solid fundamentals and a history of raising dividends. More importantly, they have the resources and will to likely pay them in the future.

Click now for a Special Report packed with unconventional wisdom and insights you simply won’t get from your neighborhood financial planner.

See our Top 5 now – the report is FREE >>Apple Inc. (AAPL) : Free Stock Analysis Report

Genuine Parts Company (GPC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.