Key Points

IonQ's trapped-ion quantum computers currently have an accuracy advantage over the competition.

D-Wave Quantum's niche approach makes it a worthy investment.

- 10 stocks we like better than IonQ ›

The quantum computing space is full of companies that have millionaire-maker potential. The difficulty lies in sorting out ahead of time which ones are most likely to actually deliver on that potential. Developing this nascent technology remains a high-risk, high-potential-reward endeavor, and many companies pursuing it are likely to go bankrupt or be bought out before reaching a point where they can offer a commercially viable quantum computing product.

In my view, these two stocks could deliver incredible returns, but there is no guarantee that either will actually do so.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

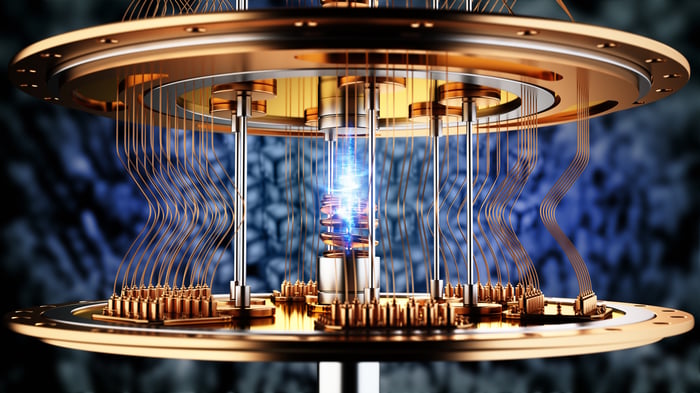

Image source: Getty Images.

1. IonQ

IonQ (NYSE: IONQ) is my top pick in this space, at least among the pure plays. Among the leading challenges in quantum computing right now are error reduction and error mitigation. The qubits that sit at the heart of all of these machines are incredibly sensitive, and that leads to an unacceptably high level of errors in their results. An inaccurate computing solution is basically worthless, so every company in the quantum computing space is looking to develop systems that will drastically reduce their error rates and allow them to correct those that do occur.

IonQ is the current leader on that front, and by a fairly meaningful margin. It gained this advantage due in part to the particular approach it's taking to quantum computing. While IonQ's trapped ion qubits have given it an accuracy advantage, the processing speeds of this type of system are slower than those of more widely pursued types of quantum computers. This could become a weakness in the future. But I think IonQ has a great chance of bringing a viable commercial product to market, which makes it one of my top choices among quantum computing stocks right now.

2. D-Wave Quantum

D-Wave Quantum (NYSE: QBTS) is taking a different approach to quantum computing than most of its competitors. Instead of trying to develop a broad-purpose quantum computer, it has built its product around a technology called quantum annealing. Such machines are best suited for optimization problems, a category that happens to include some of the most natural use cases for quantum computers in general, including solving problems in generative artificial intelligence (AI), weather modeling, logistics networks, and statistics.

The niche approach may allow D-Wave to carve out a decent market opportunity for itself, as opposed to trying to compete with everyone else to make a general-purpose quantum computer. At the same time, even potential customers that have optimization problems to address may prefer the flexibility of a broad-use quantum computer. That could reduce D-Wave's prospects.

Both of these companies have the potential to deliver monster returns if their quantum computing solutions end up being popular options. At the same time, there's a decent chance that either one or both won't make it to the finish line. Numerous well-funded competitors are vying for supremacy in this emerging technology field, and resource availability could be a defining issue in determining which ones can reach their goals.

If the prospect of a stock going to $0 scares you, but you're bullish on quantum computing, you may want to consider instead buying a quantum computing ETF that gives you exposure to nearly every publicly traded business in the space. Although the returns from that sort of a diversified investment won't be as good as investing in either IonQ or D-Wave would be if those companies' efforts pan out, they could still be high if useful quantum computing systems are developed and become a significant part of the world's computing infrastructure.

Should you buy stock in IonQ right now?

Before you buy stock in IonQ, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and IonQ wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $443,299!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,136,601!*

Now, it’s worth noting Stock Advisor’s total average return is 914% — a market-crushing outperformance compared to 195% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of February 7, 2026.

Keithen Drury has positions in IonQ. The Motley Fool has positions in and recommends IonQ. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.