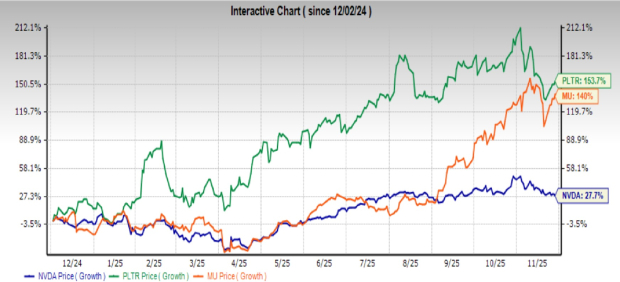

The artificial intelligence (AI) boom helped NVIDIA Corporation NVDA become the most valuable company, with a market capitalization of $4.3 trillion. Major tech firms are increasingly relying on NVIDIA’s graphics processing units (GPUs) to power new AI applications, while its state-of-the-art Blackwell chips are witnessing explosive demand. NVIDIA’s leadership in the AI hardware market has consistently boosted its sales and profits, propelling its share price by 27.7% over the past year (read more: 3 Reasons to Buy NVIDIA After Its Massive 62% Revenue Surge).

However, rising interest in AI has fueled impressive gains for Palantir Technologies Inc. PLTR and Micron Technology, Inc. MU, outpacing NVIDIA over the past year, with stock gains of 153.7% and 140%, respectively. Both companies boast a scalable business model and are considered among the few with the potential to emulate NVIDIA’s success. Here’s why –

Image Source: Zacks Investment Research

AI Adoption Surges, Raises Palantir’s Earnings and Revenues

The rising demand for Palantir’s successful Artificial Intelligence Platform (AIP) in both the U.S. commercial sector and the government segment is expected to fuel the company’s revenue and profit growth. Demand for Palantir’s AI solutions prompted the company to raise its revenue outlook for the fourth quarter to between $1.327 billion and $1.331 billion, and for the full year to between $4.396 billion and $4.400 billion, citing investors.palantir.com.

Palantir’s third-quarter revenues were $1.18 billion, up 63% year over year and 18% quarter over quarter. The bulk of the revenues came from the U.S. commercial segment, whose sales soared to $397 million in the third quarter, up 121% year over year and 29% quarter over quarter, while sales from the government segment increased 52% year over year and 14% quarter over quarter, totaling $486 million. This revenue growth signals potential long-term growth as more clients adopt Palantir’s AIP, while growing government contracts strengthen barriers to entry.

It’s worth noting that Palantir’s U.S. commercial clientele is still limited, leaving ample room for growth. Palantir’s expected earnings growth for the current quarter and next year are 64.3% and 42.5%, respectively. It has already posted an impressive $476 million in GAAP net income in the third quarter.

Micron Boosts Guidance as AI HBM Demand Fuels Strong Growth

The growing demand for Micron’s AI-focused high-bandwidth memory (HBM) chips, powering AI-enabled smartphones and certain NVIDIA semiconductors, is driving the company’s strong performance lately. The HBM chips have the inherent capacity to process large volumes of data and reduce power consumption.

The demand for HBM chips has encouraged Micron to raise its fiscal first-quarter revenue guidance to $12.5 billion. Micron’s revenues in the fiscal fourth quarter were $11.32 billion, up from $7.75 billion a year ago. At the same time, Micron’s revenues of $37.38 billion for full fiscal 2025 were up from $25.11 billion in the prior year. Notably, Micron’s core cloud memory business saw a significant increase in sales, with additional increases projected.

Citing investors.micron.com, Sanjay Mehrotra, Micron’s CEO, said that the company “is entering fiscal 2026 with strong momentum and our most competitive portfolio to date. As the only U.S.-based memory manufacturer, Micron is uniquely positioned to capitalize on the AI opportunity ahead.” Banking on this hopefulness, Micron’s projected earnings growth rate for the current quarter and next year are 110.6% and 23.4%, respectively. Micron’s net income for the full fiscal year was a healthy $8.54 billion.

Micron currently has a Zacks Rank #1 (Strong Buy), while Palantir has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

Zacks Names #1 Semiconductor Stock

This under-the-radar company specializes in semiconductor products that titans like NVIDIA don't build. It's uniquely positioned to take advantage of the next growth stage of this market. And it's just beginning to enter the spotlight, which is exactly where you want to be.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $971 billion by 2028.

See This Stock Now for Free >>Micron Technology, Inc. (MU) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Palantir Technologies Inc. (PLTR) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.