Fintel reports that Systematic Financial Management has filed a 13G form with the SEC disclosing ownership of 0.59MM shares of Silicom Ltd. (SILC). This represents 8.89% of the company.

In their previous filing dated February 10, 2022 they reported 0.53MM shares and 7.69% of the company, an increase in shares of 11.77% and an increase in total ownership of 1.20% (calculated as current - previous percent ownership).

Analyst Price Forecast Suggests 51.77% Upside

As of February 12, 2023, the average one-year price target for Silicom is $59.16. The forecasts range from a low of $58.58 to a high of $60.90. The average price target represents an increase of 51.77% from its latest reported closing price of $38.98.

The projected annual revenue for Silicom is $177MM, an increase of 17.55%. The projected annual EPS is $3.41, an increase of 24.60%.

What is the Fund Sentiment?

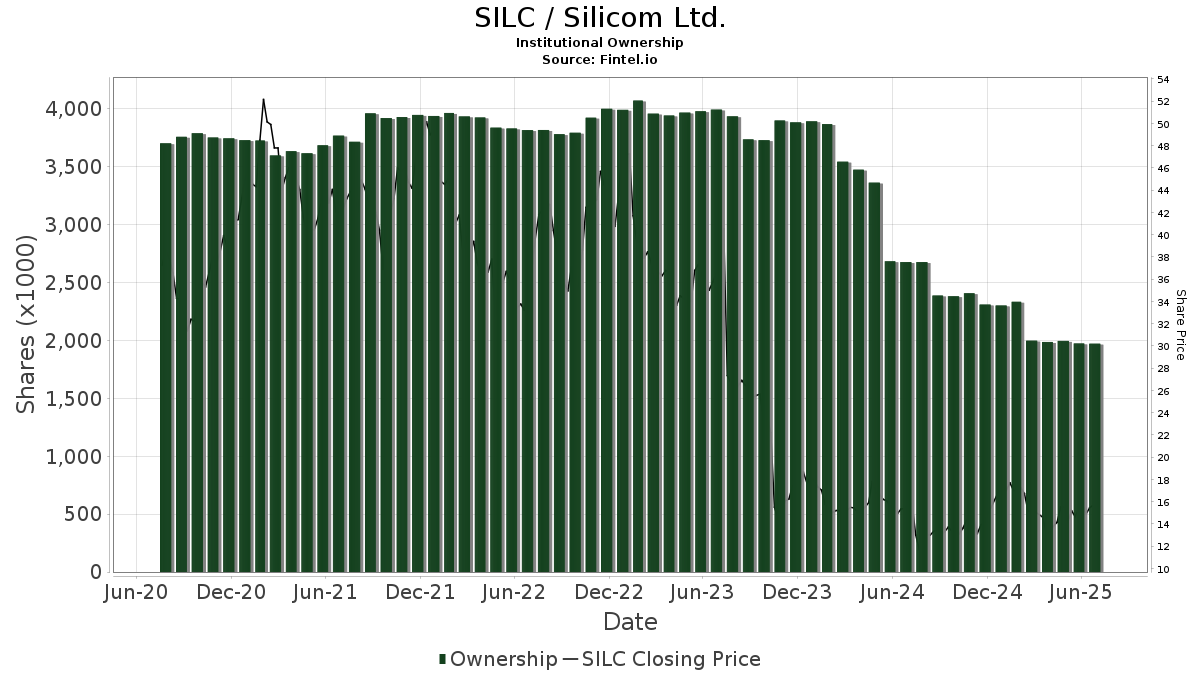

There are 76 funds or institutions reporting positions in Silicom. This is an increase of 8 owner(s) or 11.76% in the last quarter. Average portfolio weight of all funds dedicated to SILC is 0.85%, an increase of 4.37%. Total shares owned by institutions increased in the last three months by 3.98% to 4,083K shares.

What are large shareholders doing?

Wellington Management Group Llp holds 665K shares representing 9.99% ownership of the company. In it's prior filing, the firm reported owning 684K shares, representing a decrease of 2.93%. The firm increased its portfolio allocation in SILC by 7.91% over the last quarter.

First Wilshire Securities Management holds 567K shares representing 8.52% ownership of the company. In it's prior filing, the firm reported owning 568K shares, representing a decrease of 0.21%. The firm increased its portfolio allocation in SILC by 13.51% over the last quarter.

Apis Capital Advisors holds 266K shares representing 4.00% ownership of the company. In it's prior filing, the firm reported owning 257K shares, representing an increase of 3.46%. The firm increased its portfolio allocation in SILC by 45.02% over the last quarter.

Acadian Asset Management holds 167K shares representing 2.51% ownership of the company. No change in the last quarter.

Acuitas Investments holds 148K shares representing 2.22% ownership of the company. In it's prior filing, the firm reported owning 140K shares, representing an increase of 5.00%. The firm increased its portfolio allocation in SILC by 22.21% over the last quarter.

Silicom Background Information

(This description is provided by the company.)

Silicom Ltd. is an industry-leading provider of high-performance networking and data infrastructure solutions. Designed primarily to improve performance and efficiency in Cloud and Data Center environments, Silicom's solutions increase throughput, decrease latency and boost the performance of servers and networking appliances, the infrastructure backbone that enables advanced Cloud architectures and leading technologies like NFV, SD-WAN and Cyber Security. Its innovative solutions for high-density networking, high-speed fabric switching, offloading and acceleration, which utilize a range of cutting-edge silicon technologies as well as FPGA-based solutions, are ideal for scaling-up and scaling-out cloud infrastructures.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.